Estimated reading time: 10 minutes

In our series on troubleshooting activation issues, today I am going to discuss the process of activating Conn’s Credit Card via Conns.com/Activate, along with alternative activation methods.

Get ready for an exciting journey with your Conn’s Home Plus credit card! Before you can start using it to buy your dream items, you need to activate it on conns.com/activate. Don’t worry; I will guide you through the whole process with simple steps. This article not only helps you activate your card but also gives you important information about this credit card. Let’s start now and make your credit card experience easy and enjoyable!

📝 Introducing Our Handy Notepad!

Need to jot down important points or remember key insights from this post? Use our notepad for quick text formatting, saving, printing, and sharing via WhatsApp and email. Make the most of your reading experience!

Try It Now!Table of contents

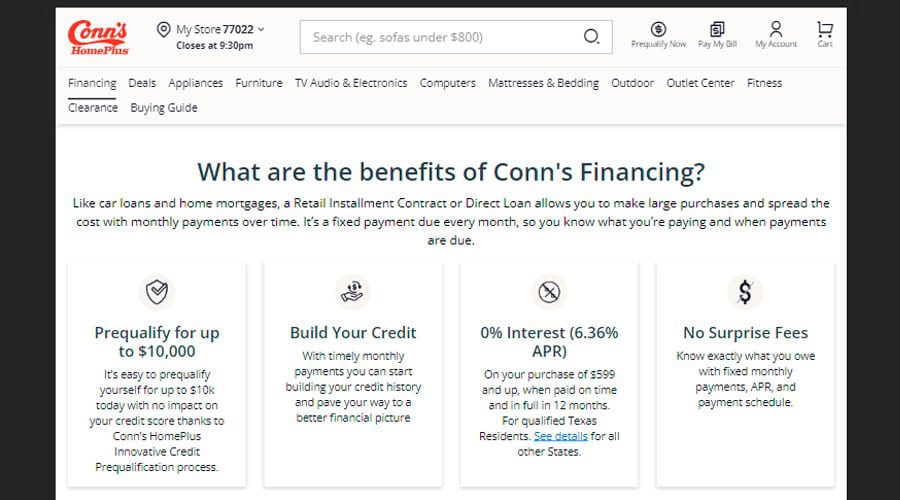

Conn’s HomePlus provides different financing options designed to meet individuals’ specific needs. By using Conn’s HomePlus credit card, you can buy a wide range of products from their stores, such as appliances, furniture, electronics, mattresses, outdoor essentials, and fitness equipment. However, in order to access these benefits, you must first activate your card.

Before diving into the activation process, let’s take a sneak peek at Conn’s HomePlus Credit Card, exploring its advantages and disadvantages.

Conn’s Home Plus Credit Card

Conn’s credit card is proudly partnered with Synchrony Bank, ensuring a secure and reliable financial experience. This partnership opens the door to tailored financing options and additional perks. Here is a brief overview of its core benefits:

Benefits of Conn’s Credit Card

- Flexible Financing: With the Conn’s HomePlus Credit Card, you can make purchases and pay over time. This allows you to take advantage of special financing offers and spread out your payments.

- No Annual Fee: The Conn’s HomePlus Credit Card does not have an annual fee, making it a cost-effective option for customers.

- Convenient Payment Options: You can make payments on your Conn’s HomePlus Credit Card through various methods, including online, in-store, or by phone.

- Manage Your Account: Conn’s HomePlus Credit Card provides online account management, allowing you to view your balance, make payments, schedule future payments, update your account information, and set up alerts.

- Special Financing Offers: Conn’s HomePlus Credit Cardholders may have access to special financing offers, such as 0% interest financing for a specific period on select purchases.

Pros and Cons of Conn’s Credit Card

Conn’s credit card comes with various benefits, but similar to other credit cards, it has its own advantages and disadvantages. Before opening a Conn’s credit account, you must know these aspects. Now, let’s quickly explore the pros and cons of using Conn’s credit card.

| Pros | Cons |

|---|---|

| Conn’s offers attractive deals on furniture and appliances, with deferred interest or low monthly payments. | Conn’s credit cards may have higher interest rates compared to traditional banks. |

| Financing made easier for subprime borrowers with streamlined in-store application and immediate use. | Purchases can only be made at Conn’s HomePlus stores and are not accepted elsewhere. Limited online functionality for managing the card. |

| Build credit history with responsible use and timely payments. | Easy financing and high interest rates can lead to debt accumulation and impact credit scores. |

| Conn’s cards provide rewards programs, like cashback or points. | Due to store-specific focus, rewards programs may not be as rewarding as other credit cards. |

| Conn’s credit cards may have annual fees. | Late payment fees and other charges may apply. |

How to Activate Your Conn’s Credit Card

Before you can activate your Conn’s credit card, you need to make sure it’s active. You can do this by calling Conn’s customer support or using the phone number on the back of your card. They will tell you if your card is active or help you reactivate it if needed. Another way to check is by trying to purchase with the card – if it is declined, it may not be active. Lastly, you can check your credit report to see if the card is listed as active. If it is, then your card is active and ready to use.

Important Information to Activate Your Conns Credit Card

To successfully activate your Conn’s Home Plus Credit Card at Conns.com/Activate, it is important to have all the following essential information ready beforehand:

Personal Information:

- Full name: The name that is printed on your credit card.

- Date of birth: Required for verification purposes.

- Social Security number: Used for credit verification.

- Contact information: Your phone number and email address, which can be used to contact you regarding your account.

Card Information:

- Credit card number: A 16-digit number located on the front of your card.

- Expiration date: The month and year when your card will expire, typically found on the front of the card.

- Security code: A 3-digit number located on the back of your card, used for online transactions.

- PIN (optional): If you intend to use your card for ATM withdrawals or PIN transactions, you can set a 4-digit PIN.

Simple Steps to Activate Your Conn’s Credit Card at Conns.com/Activate

Before you start, ensure you have your Conn’s credit card details ready. Now, let me walk you through the steps to activate your Conn’s credit card through Conns.com/Activate:

Step 1: Access your Conn’s HomePlus account

- Visit the Conn’s HomePlus website at https www conns com activate.

- If you don’t have an account, you may need to create one before proceeding.

Step 2: Navigate to the card activation page

- Once you’re logged in to your Conn’s HomePlus account, follow the on-screen prompts to find the card activation page.

- The exact location of the activation page may vary, but it should be easily accessible from your account dashboard.

Step 3: Enter the required details

- Provide the necessary details on the card activation page, such as your card information and any other requested information.

Step 4: Click the ACTIVATE button

- After entering the required details, click the “ACTIVATE” button to complete the activation process.

Step 5: Confirmation

- You should receive a confirmation message or notification once you’ve successfully activated your Conn’s credit card.

- At this point, your card is ready to be used for making payments.

Please note that the specific steps and user interface may vary slightly depending on Conn’s HomePlus website version and any updates made to the activation process. It is always a good idea to carefully follow the instructions on the website during the activation process.

Usually, activating your Conn’s credit card online through their website at conns.com/activate is a simple and convenient process. However, suppose online activations are temporarily unavailable due to security concerns, technical issues, fraud prevention, system upgrades, or regulation changes. In that case, alternative methods are available for activating your Conn’s credit card.

Also Read : BET Activation on Different Streaming Devices

Other Methods to Activate Your Conn’s Home Plus Credit Card

To activate your Conn’s credit card, you can either do it by phone or in-store. Let’s go through each method step by step:

By Phone:

The first option is to activate your card by phone. It’s a simple process, and you will just need to follow these steps:

- Pick up your phone and dial Conn’s customer service at 1-877-358-1252.

- Next, make sure you have your credit card number and personal information handy before you call.

- Once connected, the automated system will guide you through the activation process. Just listen to the prompts and follow the instructions.

In-Store:

You can activate your Conn’s credit card in-store if you prefer a more personal touch. Here’s how you can do it:

- Visit any Conn’s HomePlus location at your convenience.

- Make sure to bring your credit card and a valid ID with you.

- When you arrive, a friendly store associate will assist you with the activation process. They will guide you through the necessary steps to activate your card correctly.

Smart Ways to Maximize Your Conn’s Credit Card Benefits:

Maximizing Financing Offers:

If you’re looking to maximize financing offers, here are some tips to keep in mind:

Target large purchases: Conn’s card is particularly beneficial for financing furniture, appliances, and other big-ticket items. By using the card for these purchases, you can take advantage of special offers like deferred interest or low monthly payments.

Compare financing options: Before committing to Conn’s financing offers, comparing them with other store cards or personal loans is a good idea. This way, you can ensure you get the best deal available.

Pay off purchases within the promotional period: To avoid hefty interest charges, it is essential to prioritize paying off your balance before the promotional period ends. Setting reminders or automating payments can help you stay on track.

Responsible Credit Use:

When using the Conn’s card, responsible credit use is key. Here are some tips to keep in mind:

Budget wisely: Only charge what you can comfortably afford to repay. Remember, even low monthly payments can accumulate over time.

Avoid impulse purchases: Stick to your needs and planned purchases for furniture and appliances. It is crucial to avoid being tempted to overspend due to easy financing.

Monitor your credit utilization: Remember that the Conn’s card can impact your credit score. To maintain optimal score health, I recommend keeping your credit utilization ratio (the percentage of your credit limit used) below 30%.

Additional Tips:

Here are a few additional tips to make the most of your Conn’s card:

Make regular payments: Even if you are still in the promotional period repayment phase, making small recurring payments can help keep interest charges from accruing.

Consider store rewards: If Conn’s offers reward programs for cardholders, it’s worth factoring that into your decision. You can maximize your points or cashback potential by using these programs.

Review your statement: Regularly checking your statements for errors or unauthorized charges is important to ensure the accuracy of your account.

Build credit history: Using the Conn’s card responsibly and making timely payments can help build your credit score over time.

What is Conns.com Activate Code?

If you have recently signed up for a Conn’s card, you should make sure to activate it at conns.com/activate to start enjoying all the great benefits and rewards. The activation process is pretty simple – you just need to use a unique reference code to set everything up on Conns.com. Here’s a quick and easy guide to walk you through the activation steps:

Activation Process for Conns Reference Code:

- First off, head over to www conns com activate.

- Next, use your unique reference code to kick off the activation process.

- Finally, follow the super easy instructions to complete the activation and unlock all the incredible benefits of your Conns.com purchase.

Let’s say you have received a pre-approval in the mail for Conn’s. You have a conns com activate code like “HP1783BE,” you can use this conns com activate reference code to activate your product on Conns.com and start enjoying all the perks that come with it.

FAQs

This section covers some of the most frequently asked questions about Conn’s credit card.

Conn’s offers two main types of credit applications: in-store credit application and online credit application.

The in-store credit application allows you to visit a Conn’s store and complete the credit application process with the assistance of a Conn’s representative. Another thing to consider is filling out an application form and providing necessary documentation such as identification and proof of income.

Conn’s online credit application can be accessed through their website. Customers can complete the application process online from the comfort of their own homes. The online application usually requires customers to electronically provide personal information, financial details, and other necessary documentation.

Conn’s offers prequalification options for credit applications. While applying for credit with Conn’s, you can determine if you prequalify within minutes.

You can make payments on your Conn’s credit card through the online portal provided by Conns or by calling customer service. Also, these payments can be made both online and over the phone.

Yes, Conn’s offers credit insurance as an option to purchase. This is available when financing with their personal Conn’s HomePlus Financing option. Credit insurance options include Property, Disability, Involuntary Unemployment, and Credit Life Insurance. Full details are available on the Conns website.

Conclusion:

My guide covers all the card’s perks, how to activate it, and how to make the most of its benefits. Whether you are new to the card or want to improve your shopping experience, this post gives you the knowledge you need to use your Conn’s Credit Card effectively.